Content

To the Date forty five, you’ll want $250,100 in the the new money placed, and after that you must care for one to equilibrium across your eligible account for another forty-five weeks. On the Go out forty five, you really need to have $five hundred,100 in the the newest money transferred, and then you must look after one harmony across the eligible membership for the next forty five months. We like the new use of 15,000+ ATMs and 4,700 branches, as well as the not enough charges. Because the Chase Secure Banking account does not render one focus-results capabilities, below are a few almost every other bank account options offering a chance to earn attention on the harmony. The fresh $100 the newest membership extra is generally sufficient to pique your own interest in the a new Chase Secure Banking account. But really so it savings account boasts other rewards and you will professionals (in addition to several drawbacks) that you will want to take on too while you are comparing available alternatives.

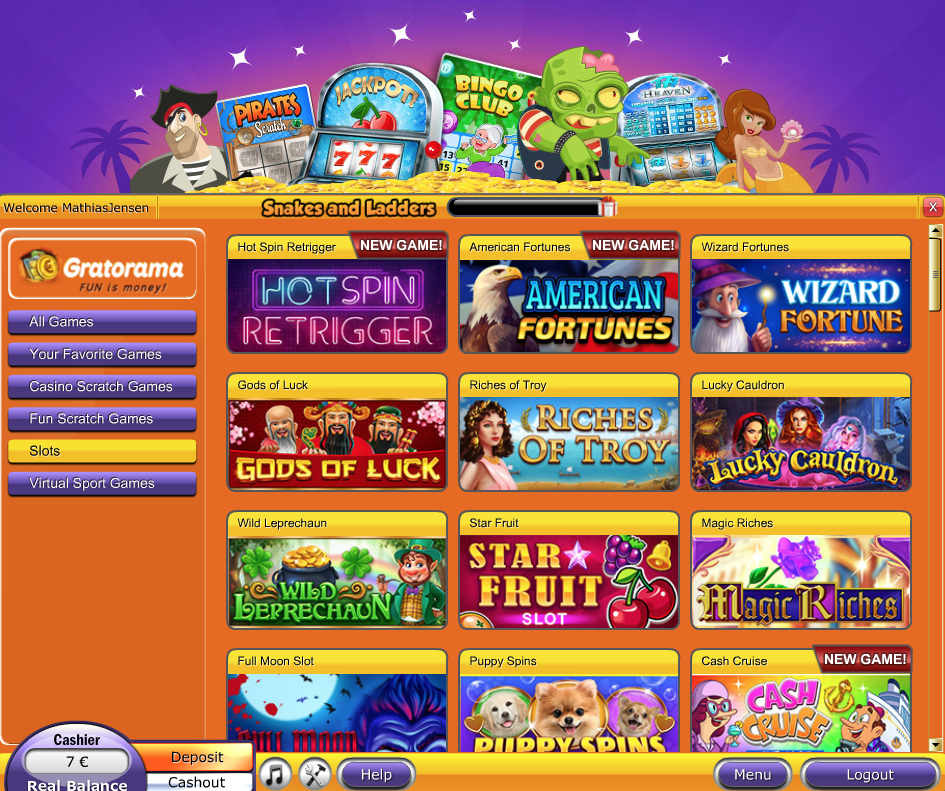

Limited-liability Companies (LLC) Listing | casino deposit 5 get 25

As well as once you have over everything proper, the new prize is not quick. This is why we have round right up it week’s finest product sales — of these which can be very easy to qualify for plus don’t include way too many headaches. Finder Us try a news service enabling you to definitely examine various other products and business. We really do not suggest specific things or organization, but not could possibly get found a payment in the team we give and you will element. If you wear’t qualify for a good Chase added bonus, you happen to be qualified to receive a plus at the other bank, for example You.S. Simply speaking, PNC are competitive, but Citi and Wells Fargo provide far greater possible bonuses while you are Lender of The usa falls small.

Superior Membership susceptible to recognition

Chase Private Consumer Examining takes customer support to the next level with priority solution, matchmaking prices and a lot fewer charges. We in addition to for instance the usage of 15,000+ ATMs and you may cuatro,700 twigs, as well as the not enough costs. Your claimed’t buy incoming otherwise outgoing cable transfers, and also you’ll getting refunded for the costs your’re also energized in the non-Pursue ATMs. If you want a checking account without fee every month from the all of the, one may get some alternatives on line or at least that have a good regional borrowing connection.

- If your bank also offers they and also you’ve establish lead put, it’s more often than not an automated cheer instead a supplementary subscription step.

- Pursue in the past merely encountered the choice to unlock a merchant account inside the person, however currently have the new accessibility to do it individually on the internet, as well.

- Such often show up mid-day and you can have a tendency to add up quick for many who’lso are currently trying to find essentials.

- For many who’lso are an armed forces representative, Pursue Armed forces Financial pros might help save you hundreds of dollars per year.

SoFi Checking and you can Family savings: Up to $300 Added bonus Render

Another along with is this account also offers Chase Overdraft Help include you against overdrafts. If you’lso are overdrawn from the $50 otherwise reduced at the end of the business time otherwise if you’re overdrawn from the over $fifty and you may bring your balance in order to overdrawn because of casino deposit 5 get 25 the $fifty otherwise quicker at the conclusion of the next business day. According to the federal mediocre interest to have discounts membership while the printed to your FDIC.gov, since Summer 23, 2025). FDIC exposure will stay during the around $8 million for private Cash Profile ($16M to have combined profile) because of spouse financial institutions.

It’s a low-cost, low-problem savings account selection for All of us college students which gain benefit from the capacity for remote financial. Direct deposit isn’t an importance of these added bonus provide. If your’re also busting costs which have members of the family or approaching your university fees repayments, that it membership helps you stay static in control while you are enjoying the independence of on line financial. Willing to create your college financial sense simpler and rewarding? Here’s how to unlock the main benefit and now have probably the most out of your Chase College Checking℠ account. Sure, you only pay taxation to your lender bonuses while they’re also experienced taxable income.

- Your don’t have to worry about dropping entry to your bank account forever.

- Actual dollars and check deposits are certainly not thought head dumps since they’re perhaps not digital.

- You simply will not need to pay an annual commission†Opens up cost and you may words inside the fresh windows for your high provides that include the Versatility Limitless credit.

- So it conflict interesting has an effect on our very own capacity to provide you with objective, purpose information about the expertise of Atomic Invest.

- That it payment get feeling just how and you may in which points appear on it website (along with, such as, the transaction in which they appear).

Your pals have to utilize the special hook so that you to get the advantage, which can be placed into your membership within ten months after your buddy opens up the new being qualified membership. You can even demand Chase to deliver their buddy your own current email address invite (however it can take several days). Your pal must play with sometimes link to sign up for the membership to be sure you receive the bonus. When you’lso are ready, consider right here to find out if a bonus is on offer for another scholar family savings.

You’ll should do your own lookup and it’ll get a little bit of experimentation observe what work, while the issues that usually result in the brand new lead deposit requirements manage alter on a regular basis. Subsequent off in this post, I have a section one to encounters options in order to cause the newest direct deposit specifications for individuals who don’t provides a means to replace your payroll deposit. In terms of lender bonuses go, this is fairly straightforward, and even, the newest Chase incentive is a staple of the financial added bonus neighborhood. Exactly why are that it bonus so essential is that they’s readily available across the country, might be opened on the internet, are frequently offered, and can end up being gained many times, even although you’ve gained the main benefit prior to. Brokerage characteristics for Nuclear Invest are offered because of the Atomic Brokerage LLC, a registered broker-dealer and member of FINRA and you may SIPC and an affiliate marketer of Atomic Purchase. Because of the relationships ranging from Atomic Broker and you will Nuclear Purchase, there is a conflict of great interest due to Atomic Invest pointing requests to help you Atomic Brokerage.

Opening a great Chase Safe Bank-account form you must invest in an excellent $4.95 monthly fee, which the bank usually subtract from your account balance. However, customers which found at the very least $250 inside electronic deposits each month will not need to spend it commission. If you are considering that it account, it is best to consider whether it is possible to effortlessly satisfy which payment waiver requirements. And you may don’t forget about that when you’ve got a good Chase examining or deals membership, you could potentially send family and you may secure more cash incentives. For those who’re also an armed forces representative, Pursue Armed forces Financial benefits may potentially save hundreds of dollars a year. Similarly, for those who’re active army, come across the review of a knowledgeable playing cards for armed forces professionals as many issuers waive yearly fees and offer quicker rates to their cards.